Harness the Power of Advanced Financial Models for Strategic Decisions

We build for our clients fully custom, dynamic financial models with more power and precision than the top hedge funds and investment banks for the price of a lawyer.

Past clients include concepts, start-ups, high net worth individuals (HNWI), hedge funds, and small to medium businesses with up to $100 million in EBITDA. For a custom financial model, the average project is between 30 and 60 hours, pending ease of access to key information.

We treat your business with white glove VIP service as if we were your CFO. Our past clients have 100% satisfaction.

* Limited time offer.

Everything Investors and a Board Want to See - Already Modeled In

Our best in class business consultants are former investment bankers, hedge fund investment analysts, and corporate CFOs that can be trusted to research, analyze, and build dynamic multi-scenario financial models with Wall Street precision.

Whether you are preparing to raise capital for a start-up, preparing to acquire or be acquired, expanding to new products, services, and locations, or restructuring for margin optimization, our models simulate the real-world impact of strategic decisions.

These models evaluate the impact of strategic decisions on revenue, EBITDA, cash flow, and valuation across complex scenarios simultaneously, which maximizes the probability your team will make the best decision.

CFO Advisor, Not Just an Excel Wizard

“Brian led due diligence on an acquisition of a diversified broker-dealer platform. He investigated and ripped apart the financials and investor materials provided by the target. He prepared a robust, dynamic financial model valuing the business. Empowered with these insights, he led late-stage due diligence Q&A with the target's executive leadership team. Brian uncovered several financial and operational red flags that made the target uninvestable at management's current valuation. Within a few weeks of Brian's recommendation to pass, the target's CFO resigned. Brian's contributions have significantly mitigated risk in our strategy. Thanks for all your hard work. Looking forward to working with you again.”

— President at Family Office Investor

“We have a large-scale software solution for the legal industry. It comprises an open enterprise platform, a marketplace and a development sandbox. Brian took the time to understand the complexities of our solution and the business underpinning it. He created bespoke economic modeling and valuations that properly, but simply captured our multi-faceted endeavor. His work was outstanding and thorough. His expertise and insights not only delivered a great product, but also added significant value to our analyses and efforts. Brian enjoys a unique mix of high professionalism and easy-going personal skills, making working with him easy and enjoyable. He was timely and his billing was fair. We plan to work with Brian again and I would not hesitate to highly recommend him to anyone.”

— CEO at Legal Tech SaaS Start-up

Schedule your free 1:1 consultation today to discuss your goals, and get your custom modeling proposal.

* Limited time offer.

Leadership Team

-

Brian Weisman, CFA

Brian is an all-around high impact business consultant who guides you like an in-house CEO/CFO. For 14 years across Wall Street and Corporate America, he built 300+ bottom-up KPI driven proprietary financial models to analyze and value companies across sectors such as technology and media, consumer and retail, energy, financial institutions, and healthcare.

Since launch, Brian has driven strategic and financial analysis for several clients from hedge funds, high net worth individuals, SaaS technology, and boutique fitness health clubs.

He graduated with a Bachelor’s degree in Finance from NYU Stern. He is on the Board of Trustees for his local synagogue. Brian is a Chartered Financial Analyst (CFA) Charterholder. He also has over 14 years of experience as an energy investment banker, an investment professional at hedge funds, and a corporate development and FP&A leader in consumer products.

Video Series

Episode 1 - How do Operational Pivots Impact Valuation?

Episode 2 - Putting the Pieces Back Together

Episode 3 - Taking Control of the Narrative and Attracting Strategic Investors

Episode 4 - Getting a Start-up Investor Ready

Episode 5 - Avoiding Losses is Important

Disclaimer: The content on this website is based on publicly available information and DOES NOT contain any material non public information about tradable securities. For private projects that lack tradable securities, all necessary written client consents and permissions were obtained by clients prior to disclosure of summary information on a no-names basis.

Common Client Problems

I need a Fractional CFO for a strategic project. How do I find one?

I have a start-up or a concept. How do I get ready for conversations with prospective investors?

My company is considering M&A or financial/operational restructuring. How should we approach this?

How do we evaluate many complex scenarios across large data sets or granular assumptions across multiple business segments?

My company is conducting a strategic review. Where can I find an expert to cut through the noise and vet assumptions before a key decision?

I’m not sure how investors will determine our valuation. Where can I find an expert who can guide me?

Solutions

-

Tackling a complex problem facing a multi scenario outcome? We provide CFO consulting services to analyze as many scenarios as you like in a dynamic financial model so that they can be simultaneously compared against one another to make the optimal decision.

-

Create custom financial models from scratch to analyze and identify the best ways to maximize growth, profitability, and ultimately valuation from your organic and inorganic strategic business decisions.

-

Guide your start-up from concept through investor discussions.

-

Lead due diligence sessions with a management team on your behalf. Lead Q&A due diligence list creation. Lead analysis of target’s financials and operations.

-

Prepare, refine, and transform an existing business plan for investor purposes or create one from scratch.

-

Combine data feeds from Business Warehouse for SAP and Adaptive Insights to feed automated financial reporting, dashboards, and financials models. Improve internal forecasts and prepare budgets with maximum efficiency.

Our Process

All projects begin with collaborative one on one meetings with the client.

During these sessions, our baseline will be to understand the client’s business opportunity as if we were the CEO.

After these meetings, we will spend time building financial models based on data provided and vetting the client’s assumptions.

Once the base case of the model is complete, we will align on multiple scenarios that modify drivers across business segments and the product and service portfolio such as unit economics, growth, and margins.

We will also add functionality for working capital, debt schedules, synergies, and pro forma M&A combinations if applicable.

We will sensitize valuation and create outputs to visualize our analysis.

As part of due diligence, we will lead Q&A with any relevant stakeholders, whether they are internal or external for the client.

We continue to refine this analysis until the client is 100% satisfied with our work.

Average time to completion for a custom strategic financial model is between 30 and 60 hours dependent on ease of access to existing financials, assumptions, and relevant information

Average time to completion for #9 plus investor presentation and business plan transformation plus Q&A / due diligence support calls plus extensive scenario modeling is between 150 and 200 hours

Average time to completion for #9 plus #10 plus CFO advisory and finance transformation at an existing business is between 250 and 300 hours

Internal Strategic Consulting

Product and Service Portfolio Gross Margin Expansion

SG&A and Corporate Overhead Cost Reductions (Personnel and Non-Personnel)

Working Capital, Solvency, and Liquidity Analysis

Earnings Quality

External Strategic Consulting

M&A and LBO

Bankruptcy and Restructuring

Debt and Equity Financing

Sum of the Parts Analysis

Testimonials

-

It was truly a pleasure working with you this past year. Your support and dedication were invaluable to us. You consistently went above and beyond, and your contributions made a significant impact on our progress... We truly appreciate everything you’ve done and look forward to the opportunity to work with you again in the future.

CEO at Boutique Gym Start-up Pre-Seed Round (Previous Client)

-

Brian led due diligence on an acquisition of a diversified broker-dealer platform. He investigated and ripped apart the financials and investor materials provided by the target. He prepared a robust, dynamic financial model valuing the business. Empowered with these insights, he led late-stage due diligence Q&A with the target's executive leadership team. Brian uncovered several financial and operational red flags that made the target uninvestable at management's current valuation. Within a few weeks of Brian's recommendation to pass, the target's CFO resigned. Brian's contributions have significantly mitigated risk in our strategy. Thanks for all your hard work. Looking forward to working with you again.

President at Family Office (Previous Client)

-

We have a large-scale software solution for the legal industry. It comprises an open enterprise platform, a marketplace and a development sandbox. Brian took the time to understand the complexities of our solution and the business underpinning it. He created bespoke economic modeling and valuations that properly but simply captured our multi-faceted endeavor. His work was outstanding and thorough. His expertise and insights not only delivered a great product but also added significant value to our analyses and efforts. Brian enjoys a unique mix of high professionalism and easy-going personal skills, making working with him easy and enjoyable. He was timely and his billing was fair. We plan to work with Brian again and I would not hesitate to highly recommend him to anyone.

CEO at Legal Tech SaaS Start-up Pre-Seed Round (Previous Client)

-

Brian is one of the brightest and hardest working investment analysts that I have ever worked with. He has a high caliber character and a strong skill set. I am very happy to recommend Brian to any firm and give him my strongest endorsement.

Portfolio Manager at Hedge Fund (Previous Employer)

-

As CIO, I worked directly with Brian on many investments. Brian is an outside the box and contrarian thinker. I consider him to be one of the sharpest and hardest working investment professionals I have ever worked with. Brian has my highest recommendation.

CIO at Hedge Fund (Previous Employer)

FAQs

-

It makes sense to provide the consultant with access to relevant financial statements. These are ideally in excel format, but they can also be in PDF format.

If the company is still just a business plan, a presentation, or a pitch, then please be ready to meet with your consultant to provide as much detail to align on the assumptions driving your business.

Our team consists of former investment bankers and hedge fund investment professionals. They are able to adapt to your situation and provide you custom tailored best in class support. -

A financial model offers a clear picture of your company’s current performance and future trajectory. More importantly, it highlights the key drivers of your business and helps identify areas where you should focus to manage risk and enhance financial outcomes. A well-constructed model signals to investors that the founders have a strong grasp of their business and a solid strategic vision. Additionally, the underlying assumptions and rationale within the model serve as essential components in determining the company’s valuation.

It also allows you to analyze complex scenarios simultaneously to drive toward the best outcome.

Case Studies

Tariff Analysis

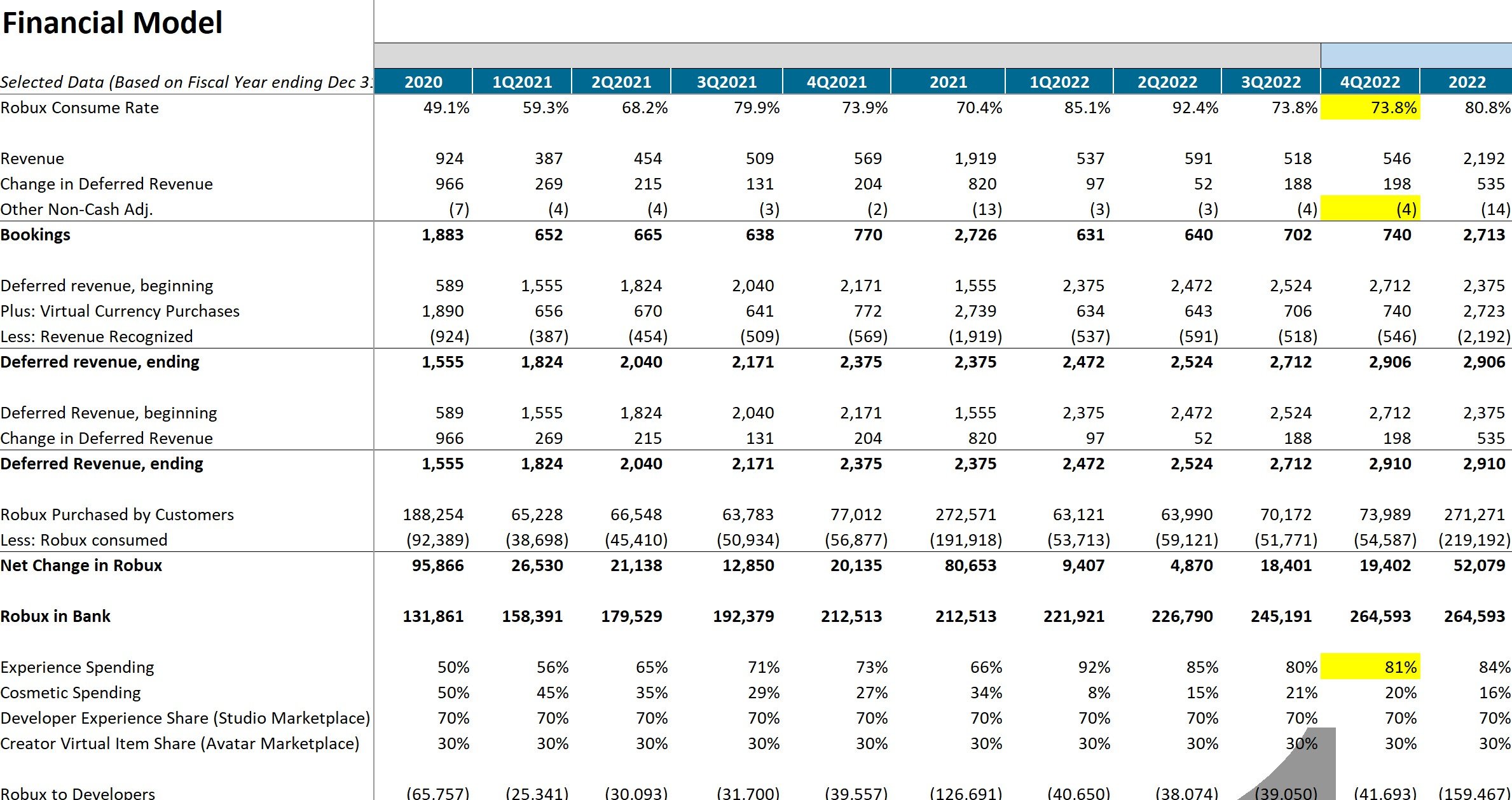

Technology, Media, and Video Games

Financial Institutions and Banks

Energy and Power Plants

Consumer and Retail

Schedule Your Free Consultation

Please complete the form below if you would like to schedule an initial consultation. A member of our team will respond to you as soon as possible.

* Your consultation is free only if you decide not to retain our services.